Statutory Management

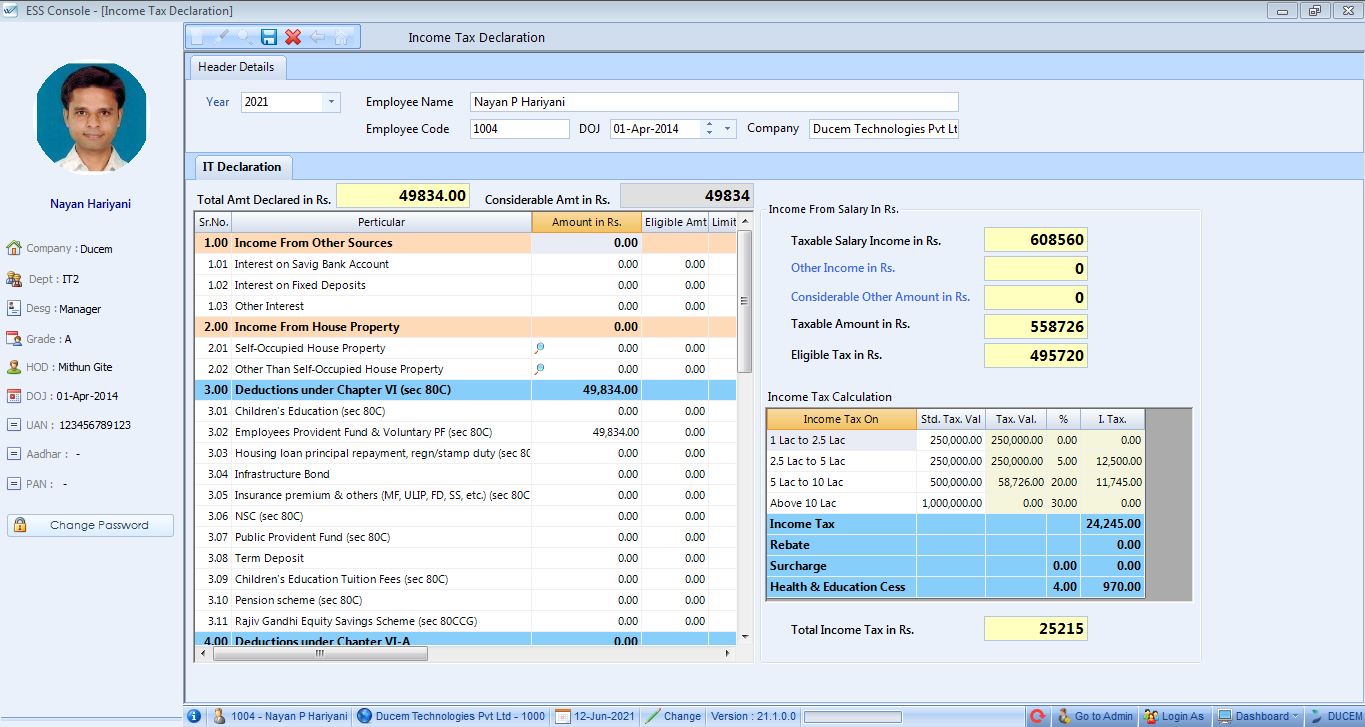

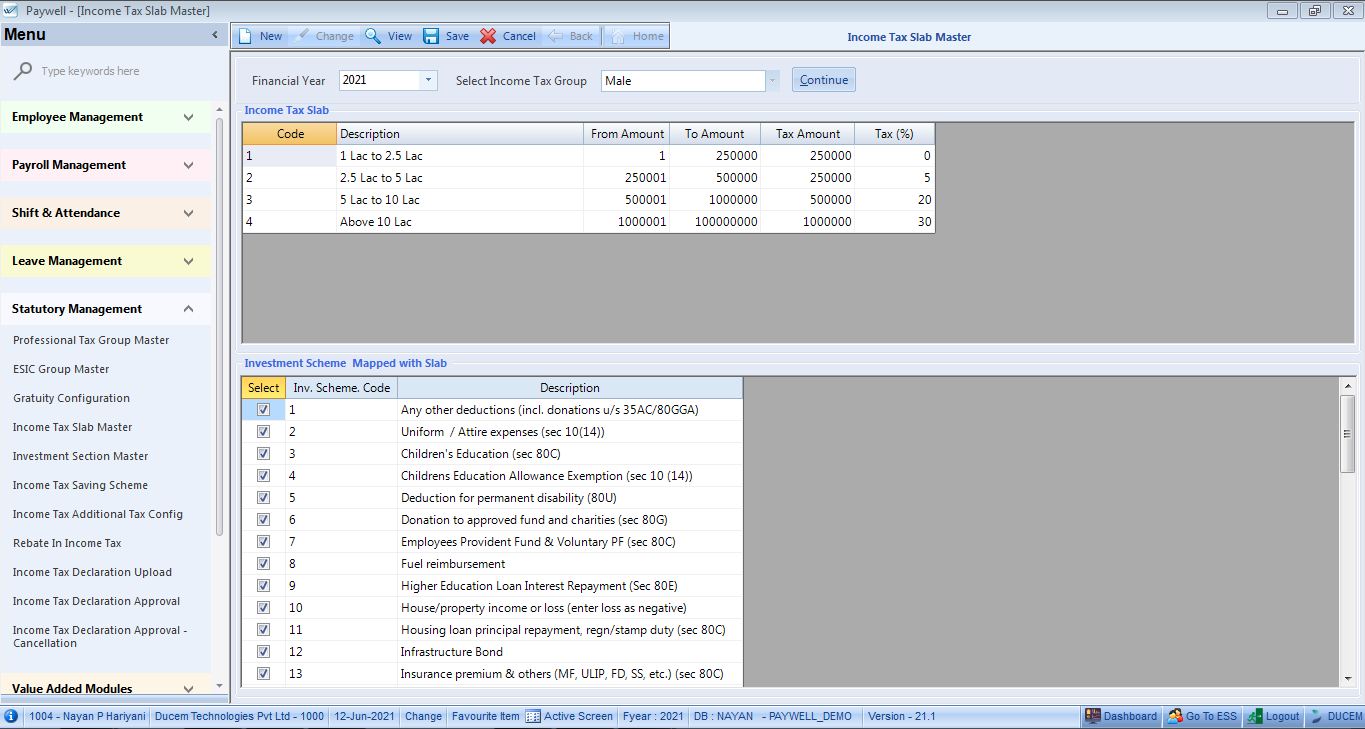

Paywell ensures state and central laws for TDS, PF & ESIC single or multiple branches companies. This payroll software keeps up with changes in laws so your business is compliant with government laws all the time. It provides smart TDS management so that anytime any change in deductions or earnings of employee, it auto calculates the applicable taxes. In this software you can generate the required Form 16 & return files then you have to just upload the generated FVU file on the income tax website.

Simplifies Statutory Compliance

Dealing with Legal work is excruciating at all times. Paywell simplifies the process for you and helps to maintain good Statutory Compliance. Paywell helps you manage everything ranging from Income tax computation to Statutory forms and challans.

Computation of Right Taxes

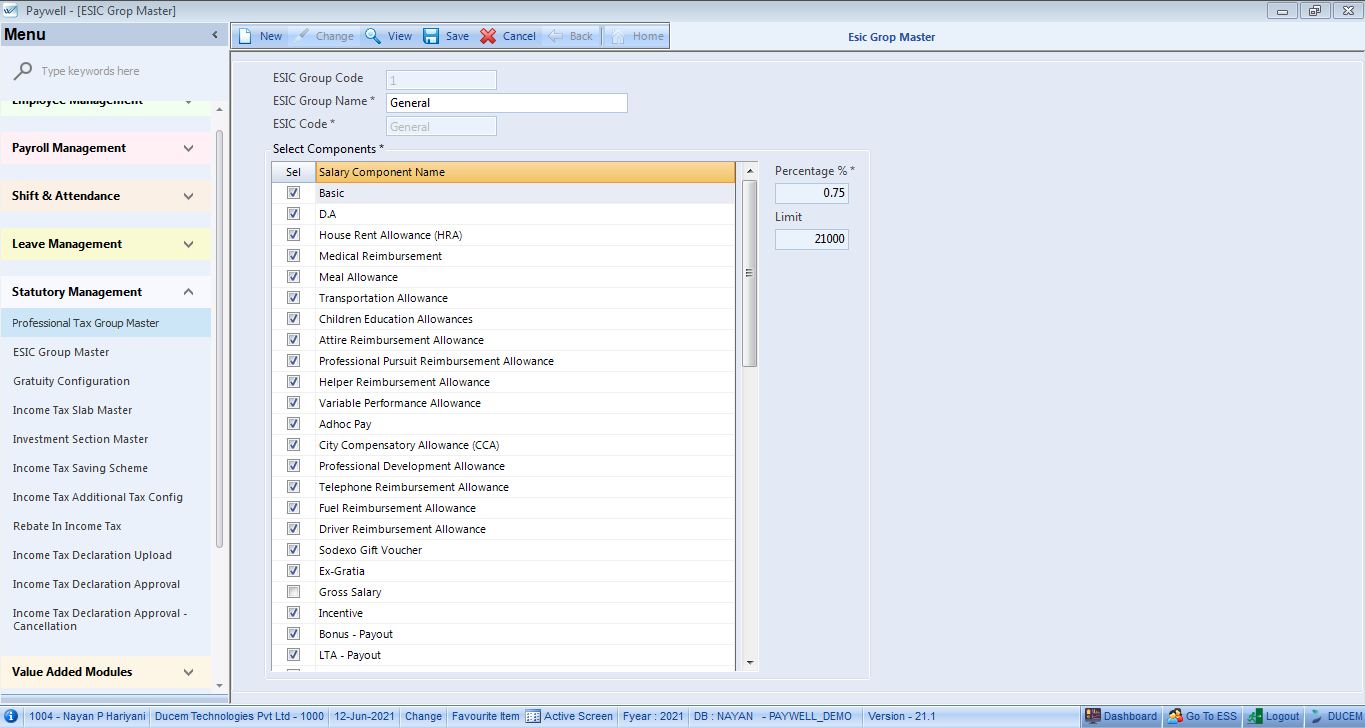

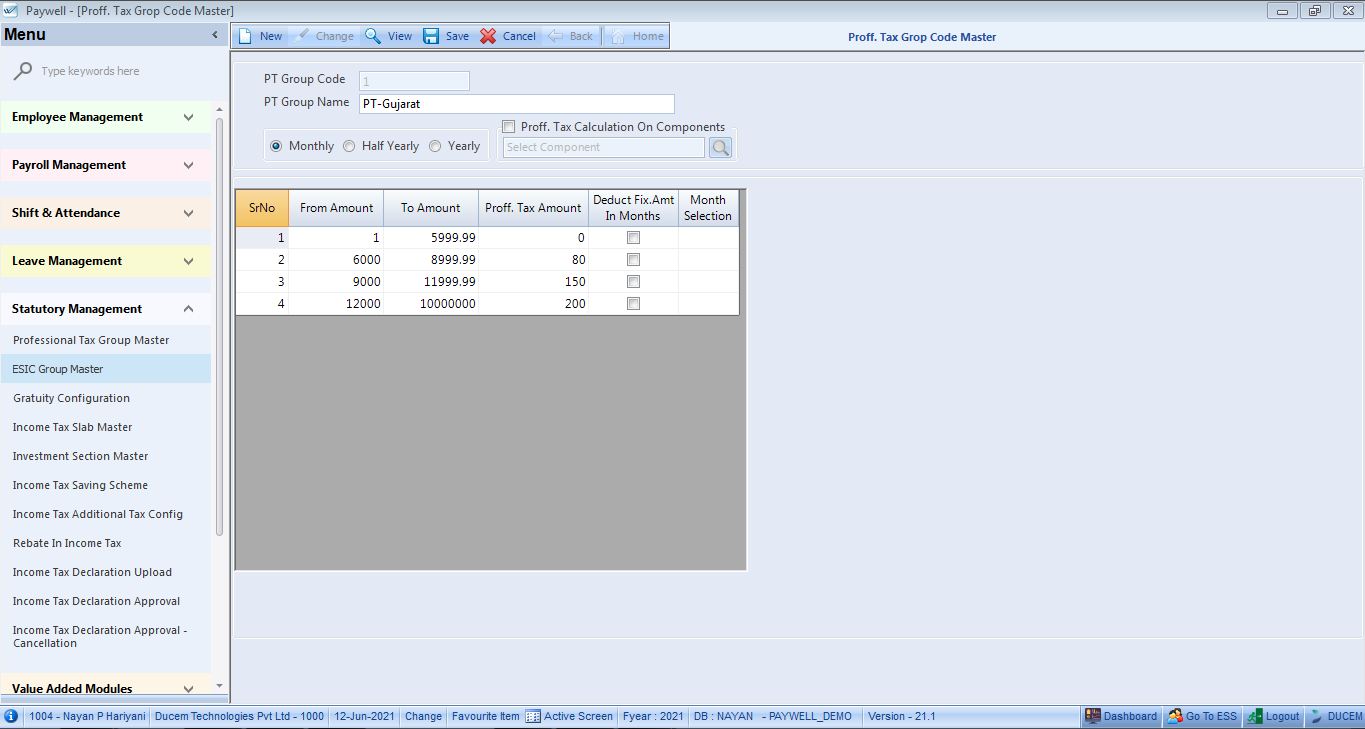

Paywell helps you stay on track and ensures that the software keeps up with the recent changes in the law. The program helps you to handle ESI and PF preferences, professional tax, wages, TDS, and automatically calculates salaries after all required deductions. It enables the generation of form 24Q and form 16 with the click of a button, assisting in the effortless and efficient management of all statutory requirements.

We also provide smart TDS management, it helps to detect any change in deductions or earnings of the employee, it auto-calculates the applicable taxes.

Minimize the Risk of Non-Compliance

Simple ignorance of statutory compliance can cause unnecessary financial losses and penal action against the Company. With the help of Paywell, all the recent changes in the regulation will be updated in software and will help you work in adherence with the Government. Our module will also auto-update the functionalities to save your time.

Smart Management

Our priority is to aid the company to reach its best. We provide support to ensure that no company is technologically challenged in the 21st Century. Being Smart is the necessity of this Era. Paywell is a reliable solution for statutory compliance management. It helps Create Area wise / City wise ESIC groups to manage the ESIC across the different plants & branches of the same company. It also calculates State wide PT as per the applicable slabs & amount for different plants & branches of the same company. No matter how widely branched or small is a company Paywell offers best services to all kinds.